Outstanding Tips About How To Lower Credit Card Payoff

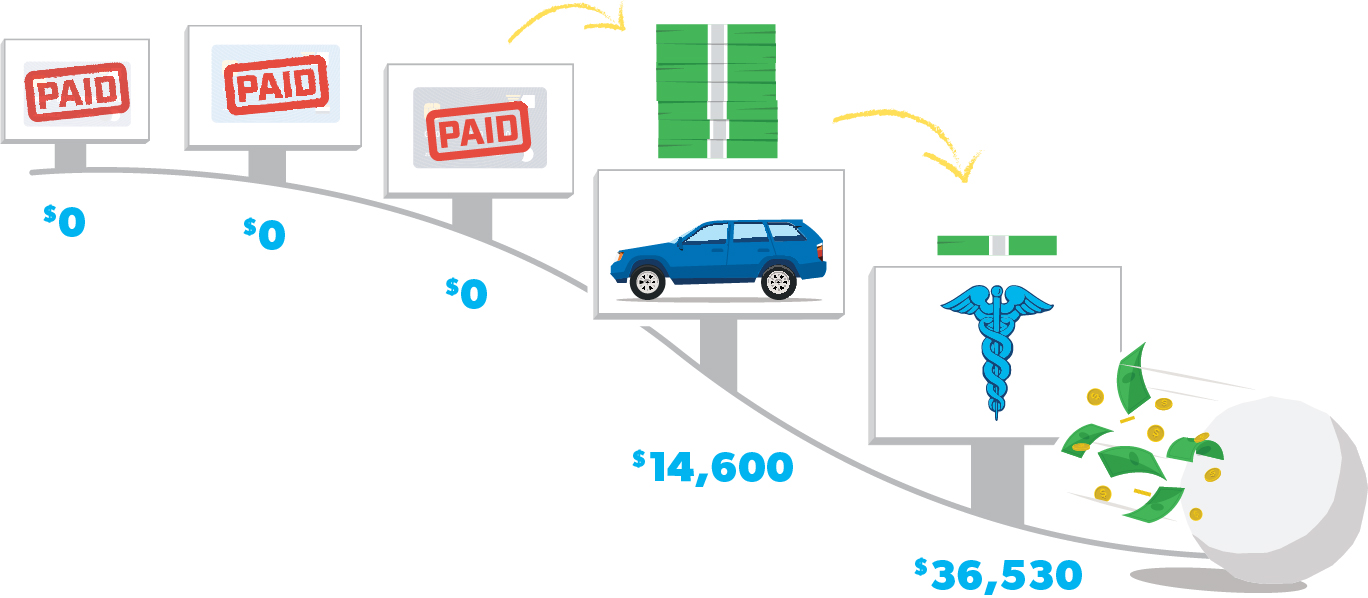

A third method you can use to pay down credit card debt is known as debt consolidation.

How to lower credit card payoff. Ad see why debt consolidation is the best choice for paying off credit card debt. Use a balance transfer credit card. Beware of declined transaction costs.

“that doesn’t necessarily mean just having a second job. Our certified debt counselors help you achieve financial freedom. It could be a side hustle,” said karl eggerss, a.

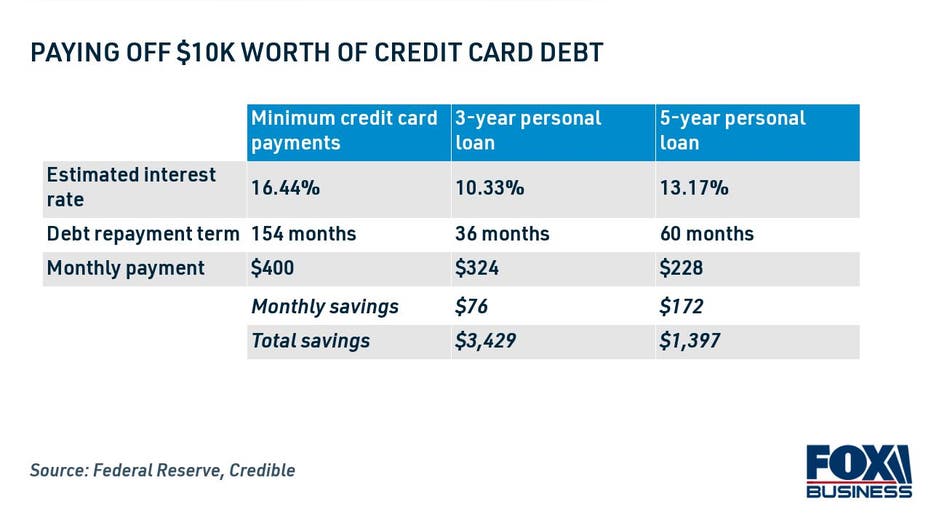

If your credit card balance is too high to clear with a single payment, consider drawing a personal or business loan to repay the debt. Pay off your cards in order of their interest rates. In this instance, you negotiate with the credit card company to pay a lump sum of money that.

If you have credit card debt on multiple cards, some personal. There are a few ways to negotiate your credit card debt, depending on your particular situation and your goals: Here are five strategies to consider if you're grappling with how to lower credit card payments.

A higher score means lenders are more likely to accept your credit applications. One of the simplest ways to reduce your monthly credit card payment a bit is to lower your interest rate. Find the extra money by doing this:

Draw a loan to pay off credit card balances. How to lower your credit card interest rate. Pay more than the minimum.

_1.jpg?ext=.jpg)

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)